Accounting system vs ERP software: the differences and advantages

Upgrading your accounting tools is likely on your radar as you embark on your digital transformation journey. The crucial question to ask yourself is: should you opt for a new accounting system or consider an Enterprise Resource Planning (ERP) software? Although accounting systems and ERP software share some similarities, they also possess unique features that can benefit your business in different ways.

So, why consider ERP software for accounting and financial management? Although ERP and accounting software share some similarities, they also possess unique features that can benefit your business in different ways.

First, let's try to understand - how can ERP benefit accounting?

Accounting software is tailored for businesses to manage their finances, covering tasks like bookkeeping, invoicing, payroll, and financial reporting. It typically focuses on financial management tasks like accounts payable and receivable.

A prime example is Unit4 Financials by Coda, a stand-alone best of breed solution designed to streamline and automate day-to-day financial processes.

On the other hand, ERP software offers a comprehensive solution that integrates various business processes into a single system. It not only handles finances but also manages operations, including supply chain management, human resources, customer relationship management, and project management.

ERP systems provide a holistic view of a company's processes and data, enabling informed decision-making.

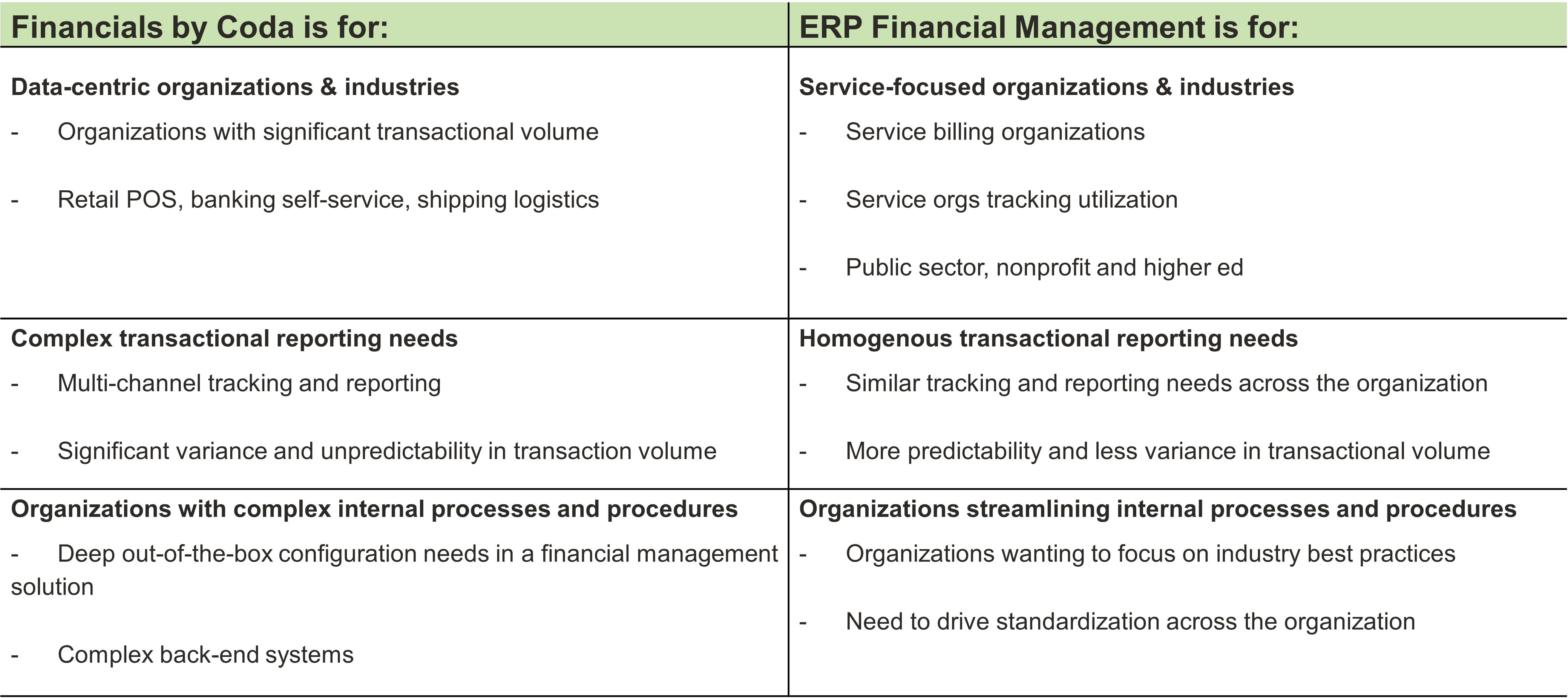

Differences between Financials by Coda and ERP Financial Management

So, what does this mean for you and your business?

The primary difference between standalone accounting systems and those within ERP software lies in their scope and focus. Accounting systems are specifically designed for financial management, while ERP systems offer a broader range of business process management capabilities.

This means that an ERP system will typically have more robust financial management features and more extensive operational management functionalities.

Customization options are another key distinction. Accounting systems tend to be more flexible, allowing businesses to adapt the system to their specific needs. While typically more rigid, ERP systems offer a more streamlined and organized approach to managing business processes.

Accounting systems are generally more affordable and accessible, particularly for smaller businesses or those with limited budgets. They are also traditionally easier to set up and use compared to ERP systems.

However, the advent of Software as a Service (SaaS) solutions has made ERP platforms significantly simpler to implement for organizations of all sizes.

In contrast, ERP systems provide a comprehensive solution for managing a business, serving as a single source of truth for data that integrates information from different departments and processes. This enables a more holistic view of a business's operations, making it easier to identify areas for improvement and make informed decisions.

ERP platforms also boast advanced features for supply chain management, project management, and customer relationship management, which can help streamline operations and improve your bottom line.

Moreover, ERP systems can enhance data security by centralizing all the data within a company, making it easier to secure and protect from unauthorized access. This is particularly crucial for businesses handling sensitive information, such as financial data.

Lastly, ERP systems can help businesses reduce IT costs and streamline operations. By integrating various processes and departments, ERP systems can eliminate the need for separate software solutions, leading to reduced IT costs.

Advanced capabilities like smart process automation also reduce the burden on your finance and HR teams, allowing them to focus on higher-value work and helping your organization respond more flexibly and resiliently to market shifts or global economic changes.

Or, as Service Performance Insight put it in their 2023 Professional Services Maturity Benchmark report:

"The fundamental financial requirements of service-based businesses are very different from classic manufacturing and supply-chain focused ERP applications as they must include functionality for managing resources (people) and projects (tasks). Increasingly, project-based ERP application providers have added rich talent management capabilities to support recruitment, onboarding, compensation, and rewards for employees, who are their core asset. The fact is that as globalization continues to evolve, PS firms need the tools to help them more efficiently and effectively operate."

Click to read ERP product brochure Gated

Ready to learn more?

Unit4 has been creating ERP systems designed specifically for the needs of service- and project-based organizations for over 40 years. Our new Cloud-native ERPx solution is specifically designed to accommodate the unique needs of firms like yours and to provide a solution that everyone in your organization can use simply, with a single great user experience.

It’s also completely modular – meaning you can start out only with the financial functions you need to begin with and plan for expansion at any time in the future.

Unit4 ERP provides a platform for the entire business – not just your finance department – enabling everyone to access critical data and make better-informed decisions about the way you allocate budget, people, and other resources to execute projects profitability. All within a single ecosystem, without the need for outside partnerships.

To learn more about how we can consolidate your operations for a simpler approach, check out this executive brief: We’re making ERP a whole lot easier.