Empower your entire organization with Extended Planning and Analysis (xP&A) to adapt to uncertainty with agility

If recent disruptions have taught us anything, it’s that an organization’s ability to plan and form an adaptable strategy that can cope with change is paramount to maintaining organizational health.

As it’s become clear that disruptions are a permanent fixture within an organization’s lifecycle, organizations looking to maintain continuous growth need not just advanced financial planning tools, but extended planning and analysis tools that go beyond just the financial function.

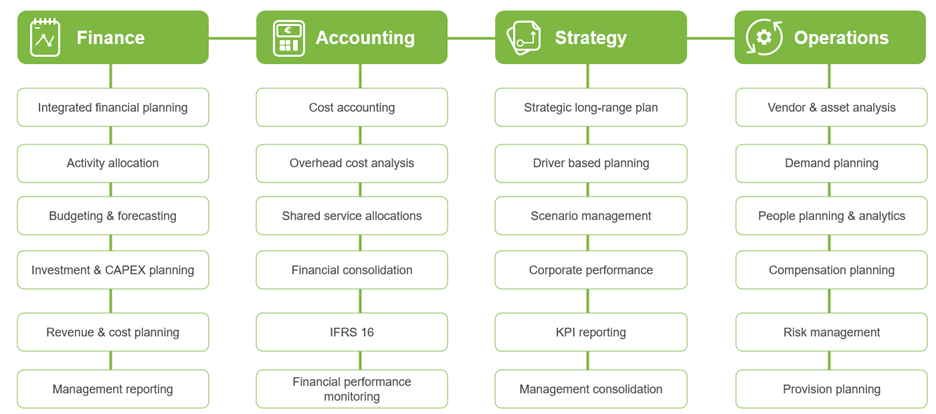

Extended Planning and Analysis tools (xP&A) are the next evolution in strategic planning and help integrate financial planning and analysis across all an organization’s functions, not just finance. This provides unrivaled agility, the ability to meet demand, and performance analysis, so you can make the decisions that count.

Keep reading to learn more about extended planning and analysis, its application, what it entails, and exactly why it’s different from financial planning and analysis.

Click to read FP&A product brochure gated

What is Extended Planning and Analysis (xP&A)?

Gartner defines Extended Planning and Analysis as: “the evolution of planning, combining financial and operational planning on a single composable platform. It ‘extends’ traditional FP&A solutions focused solely on finance into other enterprise planning domains such as workforce, sales, operations and marketing.”

In essence, organizations may have a standalone FP&A tool, but xP&A applies this concept beyond the financial function, to the other key functions and systems of an enterprise, with the advantage of one consolidated platform - for example, a unified solution that integrates ERP with FP&A

It’s evident that financial teams need to focus on strategy more. When strategic thinking is enabled across an organization into other functions by collaborating with manufacturing, sales, HR, or IT, strategic tasks become much more unified and give organizations a granular level of insight into all their operations.

What value does xP&A bring over FP&A

While FP&A is still a useful tool to transform a static financial function into strategic leaders, there is still a series of complex processes that are entailed with this. xP&A isn’t here to replace FP&A but to enable other departments to benefit from the same capabilities.

That said, Gartner finds that 96% of those surveyed agreed that a majority of enterprises will adopt a planning strategy to integrate/align FP&A with one or more operational planning areas by 2024 – which speaks to the value of strategic planning in and outside of finance.

Put simply, FP&A puts finance in the driving seat of strategy, which is important, but with xP&A all departments can have this strategic insight and functionality and collaborate with other functions through a single, unified platform.

With a unified platform for strategic planning, strategy gains a single source of truth, enabling strategy to be communicated and implemented effectively, which provides a truly competitive level of agility when organizations need to respond to disruption or changes.

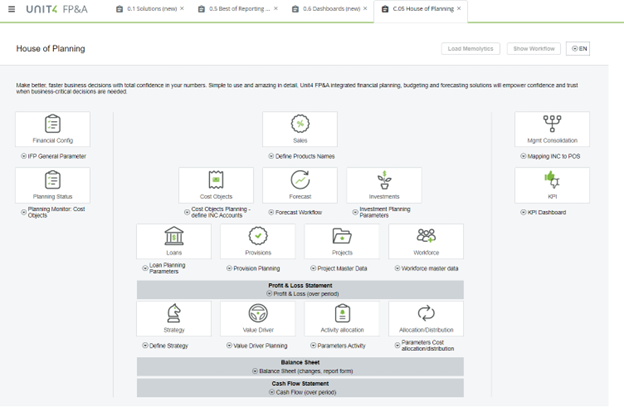

*Image 1 – Unit4 FP&A House of Planning in the FP&A Integrated Planning model

How can Unit4 help you embrace extended planning and analysis?

Unit4’s Integrated Financial Planning covers all aspects of planning across our ERP suite and collaborates with our #1 ranked Workforce Planning and Analysis solution for example. This provides a single solution and a clear view of near real-time data and figures, with forecasting capabilities, analytics, and group-specific reporting.

Users can create reports, analyze data across an organization, and define and customize their dashboards with a range of powerful visualization techniques to inform strategy.

“While Unit4 FP&A talent can be utilized stand-alone, it supports native integration with Unit4 ERP; it’s web-based, Cloud-native ERP, with predefined planning applications for workforce planning and people analytics, as well as IRFS 16 and financial and statutory consolidation.”

We offer capabilities such as:

- Integrated P&L, balance sheet & cash flow data

- Integrated view on actuals, medium- & long-term planning and forecasting

- Multidimensional views, e.g. according to regions, products, customers, etc.

- Planning for the entire group, as well as its individual entities

- Workforce planning, people analytics, IFRS16 and financial/statutory consolidation

- Powerful management consolidation, including reconciliation, intercompany rules, and audit trail

*Image 2 – A summary of some of the extended capabilities of Unit4 FP&A across more than just finance and accounting teams.

Talk to sales today to learn how we can help you implement an extended planning and analysis solution covering FP&A and ERP in your organization.